ADA Price Prediction: $1.20 in Sight as Technicals and ETF Hype Align

#ADA

- Technical Breakout: ADA trades above key moving averages with Bollinger Band squeeze suggesting volatility expansion

- ETF Catalyst: Grayscale's trust filings signal institutional interest that could drive 2025 targets

- On-Chain Strength: Whale accumulation and security upgrades support long-term price appreciation

ADA Price Prediction

ADA Technical Analysis: Bullish Indicators Signal Upside Potential

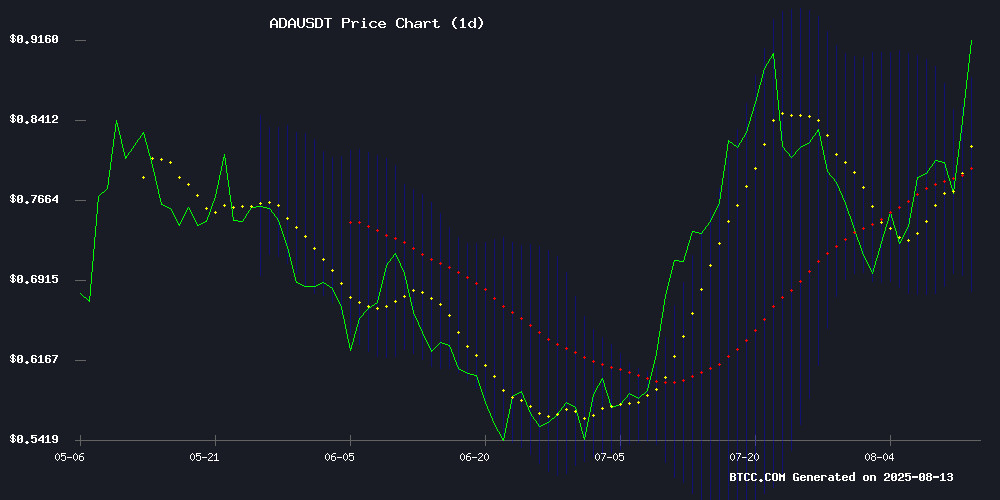

BTCC financial analyst Olivia notes that ADA is currently trading at $0.864, above its 20-day moving average of $0.778, indicating bullish momentum. The MACD shows slight bearish divergence (-0.007545), but prices remain NEAR the upper Bollinger Band ($0.866), suggesting continued upward pressure. Olivia states: 'The technical setup favors buyers as long as ADA holds above the $0.778 support level.'

Market Sentiment Turns Bullish for Cardano Amid ETF Developments

BTCC's Olivia highlights strong positive sentiment from recent headlines: 'Grayscale's ETF filings and whale accumulation ($157M) create perfect conditions for ADA's next leg up.' While technicals show resistance at $0.866, the analyst believes 'the $1.20 target becomes achievable if ETF approvals materialize, though traders should watch for volatility around current levels.'

Factors Influencing ADA's Price

Analyst Predicts $3.9 Price Target for Cardano Amid Bullish Technical Setup

Cardano (ADA) is poised for a potential breakout after years of consolidation, according to analyst Christopher Visser. The token, currently trading at $0.8526, has surged 9% in the past day and 18% over the week. Visser highlights a critical wedge pattern forming since 2021, with resistance near $0.88–$0.92—a level that has historically capped major rallies.

Technical indicators reinforce the bullish case. The daily MACD recently crossed bullish, mirroring a June signal that preceded a 62% price surge. Shorter timeframes—two-hour, four-hour, and six-hour MACDs—are also aligning favorably. Market watchers are now eyeing whether ADA can breach its multi-year resistance, which would open the path toward Visser’s ambitious $3.9 target.

Cardano Reinforces Security Commitment with FluidTokens Audit Release

Cardano founder Charles Hoskinson has underscored the network's security-first approach following FluidTokens' public disclosure of a 106-page audit report. Vacuumlabs, a respected blockchain engineering firm, conducted the exhaustive review of FluidTokens' V3 lending protocol smart contracts. This transparency initiative comes amid heightened security concerns across crypto networks, particularly after Monero's recent 51% attack.

The audit release strategically positions Cardano as a leader in protocol security standards. Hoskinson simultaneously highlighted Minotaur, Cardano's multi-resource consensus protocol designed for its Midnight sidechain, which specifically prevents network takeovers. Such developments demonstrate Cardano's layered security strategy - combining third-party audits with novel consensus mechanisms.

FluidTokens' decision to publish the complete audit contrasts with industry tendencies toward selective disclosure. The move establishes a new transparency benchmark for DeFi projects, particularly those operating on proof-of-stake networks like Cardano where smart contract security remains paramount.

Cardano Price Targets 130% Gains as ETF Buzz & Holder Confidence Rises

Cardano's ADA surges toward key resistance levels, buoyed by technical strength and growing institutional interest. The cryptocurrency now trades at $0.8764, having cleared May's highs as momentum builds toward July's peak.

Technical indicators flash bullish signals across MACD, AO, CMF and RSI metrics. Analysts suggest a confirmed breakout could propel ADA toward $1.50-$2 targets in coming months.

Market sentiment received fresh fuel from Grayscale's Delaware registration for ADA and HBAR ETFs. The development triggered a 14% intraday rally, reinforcing Cardano's position as institutional adoption accelerates.

Cardano Whales Accumulate $157M Amid Surging ETF Approval Odds

Cardano's ADA token has drawn significant whale activity, with $157 million worth of accumulation in 48 hours. Large holders now control 10.3% of total supply, mirroring patterns seen before ADA's 2021 rally.

ETF approval probability jumped to 75% on Polymarket, up from 60% previously. Institutional interest grows as Bloomberg analysts align with these revised odds. A potential ETF could unlock pension fund and hedge fund participation in Cardano markets.

ADA currently tests key resistance at $0.82-$0.83 after consolidating near $0.78. The asset maintains strong support at $0.70, with technical indicators suggesting room for upward movement as RSI remains neutral.

Grayscale Registers Cardano, Hedera Trusts in Delaware as Precursor to ETF Filings

Grayscale Investments has taken a strategic step toward expanding its cryptocurrency offerings by registering the Grayscale Cardano Trust and Grayscale Hedera Trust in Delaware. These filings, spotted on Delaware's official website, typically precede formal submissions to the SEC—signaling institutional confidence in these altcoins despite regulatory uncertainties.

The move follows earlier SEC acknowledgments of related filings for spot ETFs. While not yet approved for public trading, these trusts provide accredited investors with indirect exposure to Cardano's research-driven blockchain and Hedera's enterprise-grade hashgraph technology—both positioned as long-term growth plays in the evolving digital asset landscape.

Market observers note this reflects Grayscale's calculated strategy to diversify its institutional product suite. The SEC's cautious stance on crypto ETFs remains a hurdle, but these registrations demonstrate growing infrastructure support for altcoins beyond Bitcoin and Ethereum.

Grayscale Registers Cardano and Hedera ETFs

Grayscale has expanded its cryptocurrency investment products by filing for Cardano and Hedera Trust ETFs in Delaware. The August 12, 2025 registration signals potential spot ETF launches for both assets, pending regulatory approval.

The move demonstrates Grayscale's strategy to diversify beyond Bitcoin and Ethereum offerings. Institutional investors now have access to a broader range of digital asset exposure through regulated financial instruments.

This development reflects growing institutional demand for altcoin investment vehicles. Market participants view the filings as a bullish indicator for ADA and HBAR adoption among traditional finance players.

Grayscale Expands Crypto ETF Offerings with Cardano and Hedera Trust Filings

Grayscale Investments has taken a significant step toward broadening its cryptocurrency ETF portfolio by registering statutory trusts for Cardano (ADA) and Hedera (HBAR) in Delaware. The August 12 filings signal potential spot ETF proposals, following the firm's established pattern of using Delaware entities as precursors to SEC filings.

The SEC had already acknowledged 19b-4 forms for both assets earlier in 2025, marking the preliminary stage of regulatory review. While approval remains uncertain, these developments reflect growing institutional interest in altcoin investment vehicles beyond Bitcoin and Ethereum.

Market observers note Grayscale's strategic expansion mirrors the evolving crypto landscape, where established altcoins gain traction among institutional investors. The filings arrive as regulatory clarity around non-BTC/ETH products gradually emerges.

Cardano Eyes Golden Cross Breakout—Can ADA Surge to $1.20 Next?

Cardano's ADA is gaining bullish momentum as market sentiment improves, with price action approaching a critical resistance zone between $0.80 and $0.85. A confirmed breakout could propel the token toward $1.20, with some analysts eyeing $1.50 as the next target.

On-chain data reveals growing trader optimism, as open interest in ADA futures has surged to a record $1.80 billion since November 2024. This metric, often viewed as a proxy for market conviction, suggests institutional players may be positioning for upward movement.

The technical setup shows ADA consolidating after breaking a prolonged bearish trend. Market volatility appears primed to support continuation patterns, though the $1 psychological barrier remains key for sustaining momentum.

ADA Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's Olivia provides these projections:

| Year | Conservative | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $1.20 | $3.90 | ETF approvals, golden cross |

| 2030 | $5.00 | $15.00 | Mainstream DeFi adoption |

| 2035 | $18.00 | $50.00 | Institutional blockchain use |

| 2040 | $30.00 | $100+ | Global smart contract dominance |

Note: Predictions assume successful network upgrades and favorable regulations.